Table of Content

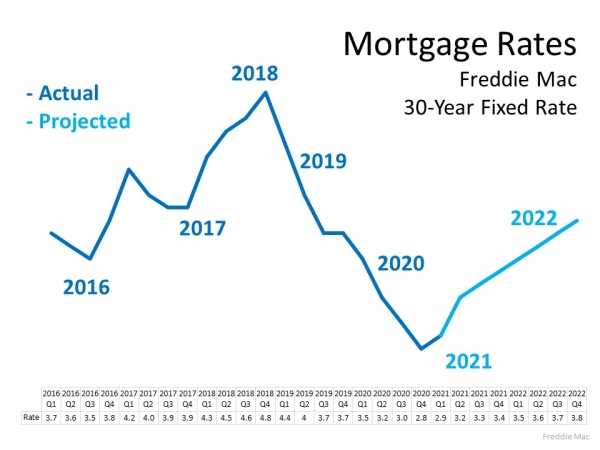

However, that may be difficult for many homeowners in this current rate environment. When mortgage rates are high, home equity loans — which don’t alter the rate on your primary mortgage — tend to be a cheaper option than cash-out refinancing. Your interest rate will also affect your monthly payment and the total cost of the loan. Given the same loan amount and loan term, a higher interest rate will result in a higher monthly payment and more money paid in interest over the life of the loan. That’s why it’s important to shop around with multiple lenders to find the lowest interest rate.

Borrowers may have to repay setup costs if the line of credit is closed within 36 months. Depending on the state in which you live, you may also have to pay mortgage taxes and an annual fee. There’s a fixed interest rate, which means the payments won’t change over the life of the loan unless you make additional draws. Now, borrowers with excellent credit and sufficient equity can secure home equity loans with interest rates as low as 5% to 6%, according to Bankrate. For example, if you have a $500,000 mortgage and you owe $350,000 on it, you have $150,000 in equity.

Home Equity Line Of Credit (HELOC)

As well as discounts based on the funds you initially use when opening the HELOC. Much like a credit card, a HELOC is a revolving credit line that you pay down, and you only pay interest on the portion of the line you use. You’ll continue to pay principal and interest on what you borrowed. Depending on tier level, Preferred Rewards members can get an interest rate discount of up to 0.625%. A second mortgage is a mortgage made while the original mortgage is still in effect.

Before you create an account, though, you can use the bank’s own rate calculator to estimate your rate and monthly payment amount. With home prices rising dramatically in the last few years, homeowners have seen a major increase in equity. Withmortgage ratesexpected to stay higher for longer, those who want toborrow money against their homeare forgetting the cash-out refinance and turning instead to home equity loans. Here’s how these installment loans work, and how to find the best rates. We reviewed nearly 20 mortgage lenders that offer home equity lines of credit for customers across the U.S. Lenders that do not display their interest rates online are not eligible for review.

Best Home Equity Loan Lenders and Rates of December 2022

And be sure to inquire about all the ways we can assist you with rate discounts. Most HELOCs have a variable rate, which means the interest rate can change over time based on the Wall Street Journal Prime Rate. If you still owe $120,000 on your mortgage, you'll subtract that, leaving you with the maximum home equity line of credit you could receive as $50,000. Learn about how a home equity line of credit works and how it may help you realize your goals – from covering unexpected expenses to paying for educational costs and funding home renovations. You understand that you are not required to consent to receiving autodialed calls/texts as a condition of purchasing any Bank of America products or services.

PenFed’s initial interest rate, 0.99% for the first six months, isn’t just a great deal; the 5% rate that could follow is also below the national average. PenFed also lets you borrow up to 90% of your home’s equity, which is more than many lenders do. A HELOC is a second mortgage on your home, so the application process is much the same as with your first mortgage. You'll need to gather your financial and personal paperwork for the lender to review. Expect to provide proof of sufficient income and secure employment through such items as pay stubs and tax returns, as well as documentation of your existing mortgage and payment history.

Home Equity Rates

Additionally, loan details vary by location — loan details presented here are based on the ZIP code. You can start your application online, but you may have to speak with a banker to get final approval. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. A home equity loan is a special type of loan that is secured against your home equity.

However, this will be dependent on personal circumstances and your credit score. However, you will not automatically be accepted for these loans just because you have equity. Your finances, income and credit score will all be assessed by the lender.

How Long To Close Home Equity Loan

While most HELOCs have aninterest-only draw period, you can make both interest and principal payments to pay off the line of credit faster. Lower gets its name from offering "lower" rates and promises a quick approval and closing process. The application process is completely online, and the application is streamlined and full of easy-to-understand language.

Navy Federal is one of the few banks on this list, allowing customers to borrow up to 100% of the home’s equity. A home equity loan is a type of mortgage loan that lets you borrow a lump sum by using your home's equity as collateral. It's often called a second mortgage and it works like a traditional mortgage in many ways. Lenders also consider similar factors to determine if you qualify and may charge closing costs. A home equity loan is a fixed-term loan that uses the equity you’ve accumulated in your home as collateral.

The process includes an eNotary who confirms customers’ identity and reviews mortgage applications and documents electronically. In addition, loans can be funded within five days after approval. Fixed-rate HELOCs have repayment terms of 5, 10, 15, and 20 years and may be subject to a $15 set up fee.

However, you could still face other serious consequences, so try to always make your payments on time and in full, if possible. Another common type of home equity financing is a home equity line of credit . HELOCs are not traditional loans where you get paid a lump sum upfront.

How To Save Money While Moving There’s a lot to plan for when moving to a new place, especially financially. Read our blog to see how you can save money during the moving process. Due to the fact that HELOCs are revolving lines of credit, they can impact, and even hurt, your credit. When you apply, typicallythe lender will run a hard inquiryto assess your creditworthiness, and that can have a small impact on your credit score. While a hard inquiry may cause your credit score to drop a few points, you should be able to recover those points if you make timely payments on your HELOC balance. The higher yourcredit score, the better your rates and the more likely you are to be approved.

On average, a DUI offense is going to cost you much more than a single collision or speeding ticket when it comes to your auto insurance bill. For example, Allstate increases average premiums by more than $70 a month -- that's more than a 30% increase. Drivers around retirement age generally enjoy some of the lowest car insurance rates out there. After all, they've likely been driving for quite some time, which usually reduces their chances of collisions and other infractions that can raise premiums. Teen drivers will almost always have the most expensive auto insurance rates of any other group of drivers out there on the road. Typically, that's because teen drivers are statistically much more likely to get into an accident that results in an insurance claim, making them much riskier to insure.

Wells Fargo Auto Loan Application

I spent a long time searching for a secured loan company my readers could trust. Before you dive into your research, you need to make sure you meet the eligibility criteria to get a HELOC or equity loan. You generally need to be at least 18 years old and plan to live in the UK for at least six months of the year.

No comments:

Post a Comment